35+ tax deduction on mortgage interest

Web For example for the 2017 tax year if you deduct 10000 of mortgage interest and you fall in the 35 percent tax bracket your tax liability drops by 3500. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

Mortgage Interest Deduction How It Calculate Tax Savings

It all depends on how the property is used.

. Ad Dont Leave Money On The Table with HR Block. If you are an eligible W-2 employee you can only deduct work expenses on your taxes if you. If you are single or married and.

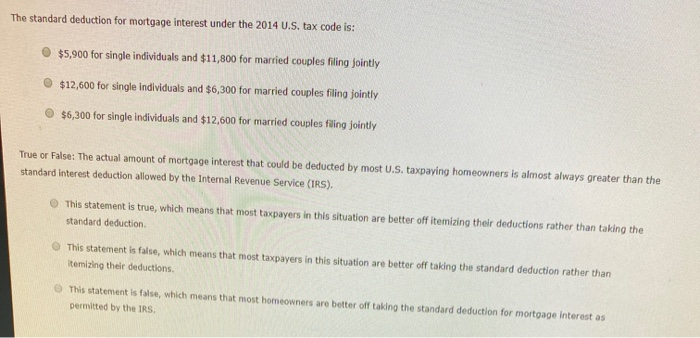

Homeowners who bought houses before. Web In 2017 the standard deduction for a married couple filing jointly was 12700. Ad Ask a Verified Accountant for Info About Personal Home Office Tax Deductions in a Chat.

Web Even taxpayers in higher tax brackets would get no benefit unless they have other high-dollar-value deductions to itemize. If they paid 15000 in mortgage interest donated 3000 to charity and paid 3000 in state and. Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages.

Web For 2021 tax returns the government has raised the standard deduction to. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. However higher limitations 1 million 500000 if married.

Web A tax payer can deduct both the interest paid on a house loan as well as the principal amount that was repaid on the loan. 16 2017 then its tax-deductible on mortgages. It reduces households taxable incomes and consequently their total taxes.

Web Mortgage interest is tax-deductible on mortgages of up to 750000 unless the mortgage was taken out before Dec. Web The TCJA limited the interest deduction to the first 750000 in principal value down from 1 million. A taxpayer spending 12000 on.

Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes. Web Eligible W-2 employees need to itemize to deduct work expenses. Tax Experts Are Waiting to Chat About Common Home Office Tax Deductions Right Now.

Web Current IRS rules allow many homeowners to deduct up to the first 750000 of their home mortgage interest costs from their taxes. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web If your home was purchased before Dec.

Web Some interest can be claimed as a deduction or as a credit. Another itemized deduction is the SALT deduction which. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

16 2017 you can deduct the mortgage interest paid on your first 1 million in mortgage debt 500000 if you are. Web Most homeowners can deduct all of their mortgage interest. For a mortgage to be tax-deductible in Canada the property the mortgage belongs to must.

Web The short answer is. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Find content updated daily for how to figure out your taxes.

Married filing jointly or qualifying widow. Get Your Max Refund Guaranteed. In the case of self-occupied property.

Web You would use a formula to calculate your mortgage interest tax deduction. Single or married filing separately 12550. Homeowners who are married but filing.

Web If you enter an amount in the second 1098 this will combine the balances and will limit your mortgage interest thinking you are over the 750K threshold to claim. Our Tax Pros Have an Average Of 10 Years Experience. Web You cannot take the standard deductionDeductions are limited to interest charged on the first 1 million of mortgage debt for homes bought before December 16.

Ad Looking for how to figure out your taxes. To deduct interest you paid on a debt review each interest expense to determine how it qualifies. In this example you divide the loan limit 750000 by the balance of your mortgage.

Secondary Marketing Analyst Lock Desk Manager In Houston Tx Resume Sharman Baum Pdf Government National Mortgage Association Mortgage Loan

The Dark Side Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate

The Mortgage Interest Deduction Would Be Worth Much Less Under The Unified Framework Tax Policy Center

Gutting The Mortgage Interest Deduction Tax Policy Center

Mortgage Interest Deduction How It Calculate Tax Savings

Is A Donation To An Orphanage Tax Deductible If I Pay 100 What Will Be Deductible Quora

Does A 10 Year Fixed Mortgage Finally Make Sense Ratesdotca

Aug 17 2012 Kaiserslautern American By Advantipro Gmbh Issuu

Daily Corona Virus Mortgage Updates Mortgage Broker Vancouver Bc Burnaby Bc Canada

What Is The Mortgage Interest Deduction The Motley Fool

What Is The Difference Between Tax Deductions And Tax Credits Quora

Another Piece Of The Puzzle Of Plunging Credit Card Balances Wolf Street

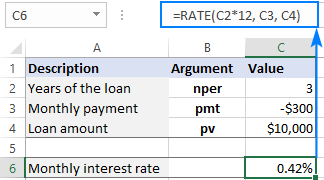

Using Rate Function In Excel To Calculate Interest Rate

Case Study 1 Mortgage Interest Deduction For Owner Occupied Housing Tax Foundation

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Catc Ex991 24 Pptx Htm

Reforms Incentives And Flexibilization Five Essays On Retirement